Volunteering with your PTA can be overwhelming—but you’re not alone. This section offers encouragement from experienced members and a sincere thank-you for everything you do.

Updated September 2024

Every week we bring hands-on fundraising advice meant to help K-12 school groups smash their fundraising goals. Join our 10,000+ member community!

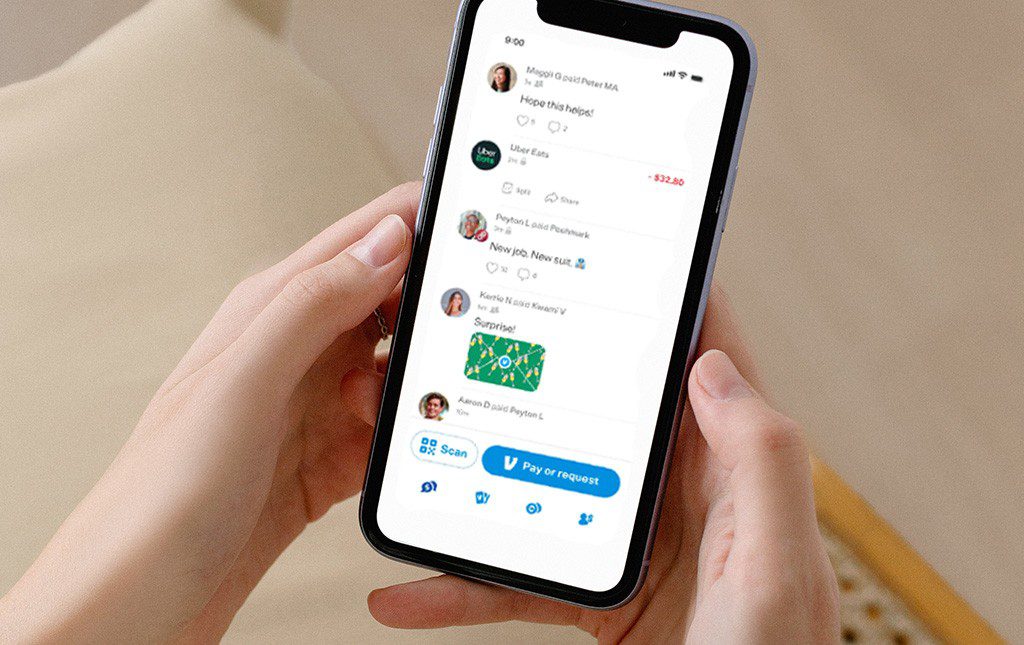

PTAs and other K-12 school groups need a secure and reliable way to accept payments for fundraisers, merch sales, and other activities. Venmo, PayPal, and similar apps make it easy for users to send and receive money, but it’s important to be aware of the risks and compliance issues that come with using these platforms.

FutureFund has helped countless K-12 school groups fundraise and collect dues with our built-in payment processing features, so we know how to make sure these tasks are done properly. Read on to learn about the risks that come with using app-based payment systems and how to avoid them.

FutureFund has built-in payment processing features, but we’re different from payment apps like Venmo or Paypal. Here’s how:

Get started for free here and find out how much easier it can be to take online payments for your school group—or keep reading to learn about the risks of different payment apps.

Two primary pieces of legislation in the US regulate the collection, use, and disclosure of student personal information:

FutureFund was designed to be compliant with these laws, but there’s no guarantee that apps designed for general use will do the same. That means school groups could face significant legal risk by using apps like Venmo or Paypal to collect names, email addresses, or payment information from students.

Before deciding to use these other apps, we strongly recommend reviewing their terms of service and privacy policies to ensure compliance with FERPA and COPPA. Or you can receive and process payments using FutureFund—since the entire platform was built to be FERPA and COPPA compliant.

Any platform you use to fundraise or collect money for your organization needs to be two things: fast and accurate. Since most PTAs and PTOs are processing high volumes of transactions on an ongoing basis, even small mistakes or delays can cause major accounting problems.

We don’t typically expect automated payment apps to make errors, but it can happen. Furthermore, most of these apps don’t provide tools that give you the necessary visibility for tracking large volumes of incoming and outgoing revenue, the way FutureFund does.

Major payment apps have huge client bases, with users making transactions from all over the world. This heavy volume can sometimes overload the apps, holding up pending transactions and delaying reports. Either outcome can wreak havoc on the careful budgeting of PTA or PTO organizations.

Not only does FutureFund sidestep these issues as a platform dedicated specifically to use by PTAs and PTOs, but we also provide tools to help with budgeting. Check out our free budget template, which you can use as a backup method to ensure your expenditures and incoming revenue are always correct and visible no matter what platform you use to collect payments.

Some apps can encounter compatibility issues when trying to process transactions from users’ banks (for instance, many banks do not accept Venmo). This can do more than simply cause transactions to be declined—it can also result in fees, both of which can have a severe impact on your organization’s ability to fundraise effectively.

Apps also charge processing fees for different types of payments—and these aren’t always consistent across platforms or easy to track. This can make your accounting considerably more difficult if you’re accepting payments from a wide variety of students and their parents or guardians—some of whom might be paying online while others want to use cash, checks, or credit cards.

FutureFund is FREE for schools, PTAs, and school groups. Start your fundraiser today!

Get StartedThere are a few things your PTA or PTO can do to ensure that the issues outlined above don’t prevent you from fundraising effectively. Here are our suggestions:

All payment apps have their own Terms of Service, which determine how funds can be transferred and accessed. If you do decide to use an app to collect payments for your PTO, you’ll need to read these carefully beforehand to make sure you understand what you’re agreeing to and the risks involved.

Not reading the Terms of Service for a given platform can lead to nasty surprises involving payment delays, account lockouts, and even the theft of your personal information if the app isn’t completely secure. Always go over these details carefully—or simply use FutureFund, which integrates seamlessly with all major payment apps but doesn’t require you to share your personal data with them.

Not only does FutureFund accept payments through all major payment apps and credit cards, but it also supports offline payments such as cash and checks. This makes it easier to accept payments from your organization’s many donors, members, or pledges, and track all of their payments in a central location where you have easy visibility into how much you’ve raised.

Get started with FutureFund now to avoid the risks associated with payment apps and find secure solutions for meeting your organization’s fundraising goals.

FutureFund provides different reports to help you see how funds are distributed to each of your campaigns. This makes it easy to accurately track financial transactions to your school group. Visit our Payouts Support Page to learn more about each different report type and how to use it.

FutureFund charges donors a small fee for each transaction they make, which lets school groups use the platform for free. This keeps things simple and ensures that we’re only making money when your organization does.

We use several advanced measures to make sure credit card details and other sensitive pieces of information are protected during transactions. One method we use is credit card tokenization, which uses randomly generated tokens to replace each cardholder’s account number so the transaction can be tracked without putting their security at risk.

Yes! Many fundraising platforms and payment apps come with the risk of losing money when a transaction is disputed because you need to respond to each dispute manually or risk having it settled in favor of the party who filed against you.

FutureFund is different—our platform makes it easy to respond automatically when transactions are disputed, potentially saving you thousands of dollars per year in revenue that would otherwise be lost.

See what other parents and schools are saying about us!

Volunteering with your PTA can be overwhelming—but you’re not alone. This section offers encouragement from experienced members and a sincere thank-you for everything you do.

What’s a quorum? What do SEC and ELAC stand for? This glossary breaks down essential PTA terms and acronyms so you can stay in the loop and speak the language.

Running a PTA takes work—but the right tools make it easier. This guide for volunteers rounds up the best free templates, digital tools, and official PTA resources to help you succeed.

Not sure what to expect as a new PTA volunteer? You’re not alone. This guide answers common questions and shares practical tips to help you get started with confidence.

Starting a PTO benefits parents, teachers, and your school community as a whole. Learn how to start one here with this guide from FutureFund that lays out the process in a series of easy steps.